Strategic Embedded Payments for Growth-Stage Software Platforms

Capture recurring payment revenue and deliver an exceptional merchant experience—without building from scratch.

Comprehensive Payment Solutions for ISV Platforms

Credit & Debit Card Processing

Card Processing Overview

Complete Card Acceptance Accept all major card brands through a single integration:

- Visa, Mastercard, American Express, Discover

- Domestic and international cards

- Credit, debit, and prepaid cards

- Corporate and purchasing cards

Processing Environments

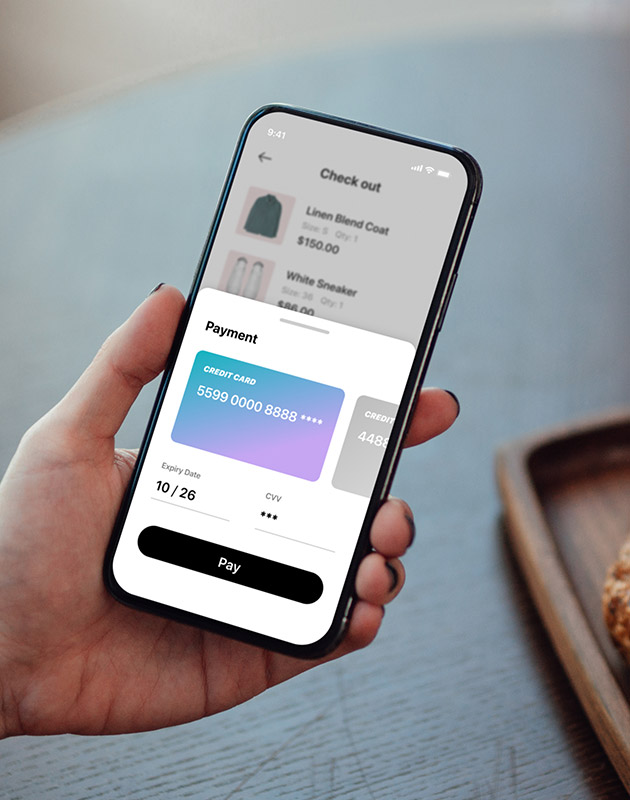

- Card-Not-Present (CNP): Online, mobile app, and phone transactions

- Card-Present: In-person transactions with integrated terminals

- Hybrid Processing: Seamless switching between online and in-person for omnichannel merchants

Card Processing Use Cases

E-commerce & Online Transactions

- Professional services (consultants, agencies, freelancers)

- Retail and product sales

- Subscription and membership services

- Event registration and ticketing

- Course and training enrollment

In-Person Transaction Support

- Retail point-of-sale systems

- Event check-in and on-site sales

- Mobile payment acceptance for field services

- Pop-up and temporary location sales

Recurring Billing Scenarios

- Monthly subscription services

- Membership fees and dues

- Installment payment plans

- Automatic renewal processing

- Usage-based billing cycles

Card Processing Features

Advanced Authorization Management

- Real-time authorization

- Partial authorization support for prepaid cards

- Authorization hold capabilities for reservations

- Incremental authorization for variable amounts

Security & Fraud Prevention

- PCI Level 1 compliant processing

- Advanced fraud scoring and machine learning

- 3D Secure authentication for high-risk transactions

- Customizable fraud rules and velocity checking

- AVS and CVV verification

Optimization Tools

- Account updater services to maintain current card data

- Retry logic for failed transactions

ACH & Bank Transfer Processing

ACH Processing Overview

Complete ACH Capabilities Process bank-to-bank transfers for cost-effective payment acceptance:

- ACH debits for customer payments

- ACH credits for refunds and payouts

- Next Day ACH for faster processing

- Pre-authorized banking debits for Canadian transactions

Processing Types

- One-time ACH payments for large transactions

- Recurring ACH for subscription and membership models

- Routing number verification for immediate bank routing validation

ACH Use Cases & Benefits

High-Value Transaction Processing

- Tuition and education payments ($1,000-$50,000+)

- Yearly membership fees

- B2B payments and invoicing

Recurring Payment Optimization

- Monthly membership fees and subscriptions

- Utility and service billing

- Loan and financing payments

- Charitable recurring donations

- Automatic investment and savings transfers

Cost-Sensitive Scenarios

- Large transaction amounts (typically >$500)

- High-volume recurring payments

- Price-sensitive customer segments

- Non-profit organizations maximizing donation impact

- B2B transactions where speed is less critical than cost

ACH Processing AdvantagesCost Efficiency

- Fees typically 50-80% lower than card processing

- No interchange fees or card brand assessments

- Reduced processing costs for recurring transactions

Higher Success Rates

- Lower decline rates compared to credit cards

- Reduced risk of expired payment methods

- Direct bank account access eliminates credit limits

Cash Flow Benefits

- Direct bank account funding improves merchant cash flow

- Predictable deposit timing (1-2 business days)

- Lower chargeback and dispute rates

- Reduced friendly fraud compared to card transactions

Digital Wallet Integration

Digital Wallet Support

Major Wallet Platforms Seamless integration with leading digital wallets:

- Apple Pay for iOS users and Safari browsers

- Google Pay for Android users and Chrome browsers

- Samsung Pay for Samsung device users

Digital Wallet Use Cases

Mobile-First Experiences Optimized for platforms serving:

- Mobile app users who prefer touch-based payments

- Younger demographics comfortable with digital wallets

- Quick-service businesses requiring fast checkout

- On-the-go transactions and mobile commerce

- Event and venue-based payments

Enhanced Security Scenarios Ideal for:

- High-value transactions requiring additional authentication

- Security-conscious customer segments

- Compliance-heavy industries requiring strong authentication

- Fraud-prone transaction types needing tokenization

- International transactions requiring local payment preferences

Conversion Optimization Perfect for:

- Reducing checkout abandonment rates

- Improving mobile conversion rates

- Streamlining repeat customer experiences

- Cross-platform payment consistency

- Guest checkout optimization

Digital Wallet Benefits

Improved User Experience

- Faster checkout with stored payment credentials

- Reduced form completion requirements

- Cross-device payment consistency

- Reduced password and account management burden

Higher Conversion Rates

- Industry average of 20-30% improvement in mobile conversion

- Reduced cart abandonment through simplified checkout

- One-touch payment approval increases completion rates

- Trust signals from recognizable wallet brands

- Streamlined guest checkout experiences

Enhanced Security

- Tokenized payment data reduces breach risk

- Biometric authentication adds security layer

- No stored card data on merchant systems

- Dynamic security codes for each transaction

- Built-in fraud protection from wallet providers

Specialized Payment Solutions

International Payment Processing

International Payment Acceptance

- Payment acceptance in Canada, New Zealand and Australia

- Multi-currency processing and settlement

- Local payment method support by region

- International ACH and wire transfer capabilities

- Region-specific compliance and tax handling

Use Cases for Global Platforms

- Software platforms serving international markets

- Educational institutions with global student populations

- Non-profits accepting international donations

- B2B platforms with global supplier networks

- Membership organizations with worldwide members

Industry-Specific Solutions

Non-Profit and Fundraising

- Donation processing with tax receipt automation

- Recurring giving programs with donor management

- Event fundraising and auction payment processing

- Grant and foundation payment acceptance

- Compliance with charitable giving regulations

Education and Childcare

- Tuition and fee processing with payment plans

- Field trip and activity payment collection

- Lunch program and cafeteria payments

- After-school and camp registration fees

- Parent portal integration for family payments

Professional Services

- Project-based billing and milestone payments

- Retainer and advance payment processing

- Time and materials billing integration

- Expense reimbursement and client billing

- Professional membership and certification fees

Advanced Payment Features

Flexible Payment Plans

- Installment payment scheduling

- Automatic payment plan management

- Early payment discounts and incentives

- Deferred payment options for qualified customers

Reporting and Analytics

- Comprehensive transaction reporting by payment method

- Payment method performance analytics

- Customer payment behavior insights

- Revenue optimization recommendations

- Chargeback and dispute analysis by payment type

Integration

Technical Setup

Single API Integration

- Unified API supports all payment methods

- Consistent integration pattern across payment types

- Shared authentication and security protocols

- Common webhook structure for all transaction types

- Unified testing and certification process

- Integration methods that reduces ISV PCI compliant scope

Customization Options

- White-label payment forms for brand consistency

- Custom payment method selection and ordering

Payment Method Selection Strategy

Merchant Optimization SafeSave helps your platform optimize payment method selection:

- Cost Analysis: Guidance on when to promote ACH vs. card payments

- Conversion Optimization: A/B testing payment method presentation

- Customer Segmentation: Tailored payment options based on customer profiles

- Industry Best Practices: Payment method recommendations by vertical

- Performance Monitoring: Ongoing analysis of payment method effectiveness

Revenue Maximization

- Strategic promotion of lower-cost payment methods

- Incentive programs for preferred payment methods

- Merchant education on payment method economics

- Custom reporting on payment method profitability

Security and Compliance

Universal Security Standards

Comprehensive Protection All payment methods benefit from:

- PCI Level 1 compliance across all credit card transaction types

- End-to-end encryption for payment data

- Tokenization to reduce data storage requirements

- Advanced fraud detection across all payment channels

- Real-time transaction monitoring and alerting

Method-Specific Security

- Card Processing: 3D Secure, CVV verification, address validation

- ACH Processing: Velocity checking, risk scoring

Digital Wallets: Tokenization, biometric authentication, device fingerprinting

Regulatory Compliance

Industry Standards

- PCI DSS compliance for card data handling

- NACHA compliance for ACH processing

- GDPR compliance for international transactions

Ongoing Compliance Management

- Regular security audits and assessments

- Compliance monitoring and reporting

- Regulatory update implementation

- Merchant compliance education and support

- Incident response and breach notification procedures